Governments globally are adopting different schemes and legislations to attract international direct investments.

To examine the suitableness regarding the Gulf as being a location for foreign direct investment, one must assess whether or not the Arab gulf countries provide the necessary and adequate conditions to encourage FDIs. One of many important criterion is political stability. Just how do we evaluate a state or perhaps a area's security? Governmental stability depends to a significant degree on the content of inhabitants. People of GCC countries have plenty of opportunities to help them attain their dreams and convert them into realities, which makes many of them content and happy. Also, international indicators of political stability unveil that there is no major political unrest in the area, and the incident of such a eventuality is very not likely given the strong political determination plus the farsightedness of the leadership in these counties especially in dealing with crises. Furthermore, high rates of misconduct can be hugely detrimental to international investments as investors dread risks including the obstructions of fund transfers and expropriations. Nonetheless, regarding Gulf, specialists in a study that compared 200 counties categorised the gulf countries as being a low risk in both aspects. Certainly, Ramy Jallad in Ras Al Khaimah, a prominent investor would probably attest that a few corruption indexes confirm that the Gulf countries is increasing year by year in cutting down corruption.

The volatility associated with exchange rates is something investors just take seriously because check here the vagaries of currency exchange rate changes may have a direct effect on the profitability. The currencies of gulf counties have all been fixed to the US dollar since the late 1990s and early 2000s, and investors such Farhad Azima in Ras Al Khaimah and Oussama el-Omari in Ras Al Khaimah may likely view the pegged exchange rate being an important seduction for the inflow of FDI to the country as investors do not need certainly to be worried about time and money spent manging the currency exchange uncertainty. Another crucial advantage that the gulf has is its geographical position, situated at the crossroads of three continents, the region serves as a gateway to the quickly raising Middle East market.

Nations around the world implement different schemes and enact legislations to attract foreign direct investments. Some countries for instance the GCC countries are progressively embracing pliable regulations, while some have actually reduced labour costs as their comparative advantage. The many benefits of FDI are, needless to say, mutual, as if the international firm discovers lower labour expenses, it is able to reduce costs. In addition, if the host state can grant better tariffs and savings, the business could diversify its markets via a subsidiary branch. Having said that, the state should be able to develop its economy, cultivate human capital, enhance job opportunities, and provide usage of expertise, technology, and abilities. Thus, economists argue, that most of the time, FDI has generated efficiency by transferring technology and knowledge towards the country. Nevertheless, investors consider a many factors before deciding to invest in new market, but among the significant variables they consider determinants of investment decisions are geographic location, exchange volatility, political security and government policies.

Tia Carrere Then & Now!

Tia Carrere Then & Now! Jenna Von Oy Then & Now!

Jenna Von Oy Then & Now! Jane Carrey Then & Now!

Jane Carrey Then & Now! Barbara Eden Then & Now!

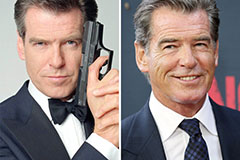

Barbara Eden Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!